Guard Set

Features

Why Rosen Bridge?

Multi-Layer Protection

Safeguarded by two distinct layers of security.

Smart Contract Reduction

Uses Ergo as a secure and cost efficient hub, minimizing smart contracts on bridged chains and ensuring scalable growth.

Incentivized

Watchers and Guards are being rewarded in a Proof of Event scheme.

Open Source

Safe and transparent, with openly accessible source code for public review and inspection.

Auditable Trace

Facilitates seamless auditing by tracking events on the Ergo blockchain.

Risk Mitigation

Reduces hacking incentives by utilizing cold storage mechanisms.

Direct Verification

Relies on direct off-chain verification of events in the origin blockchain with no smart contract or proof dependency.

Scalable

Easily accommodates new chains by integrating independent, chain-specific modules.

Safe for Users

Waiting for enough confirmations on events before taking actions ensure transactions are successful.

Architecture

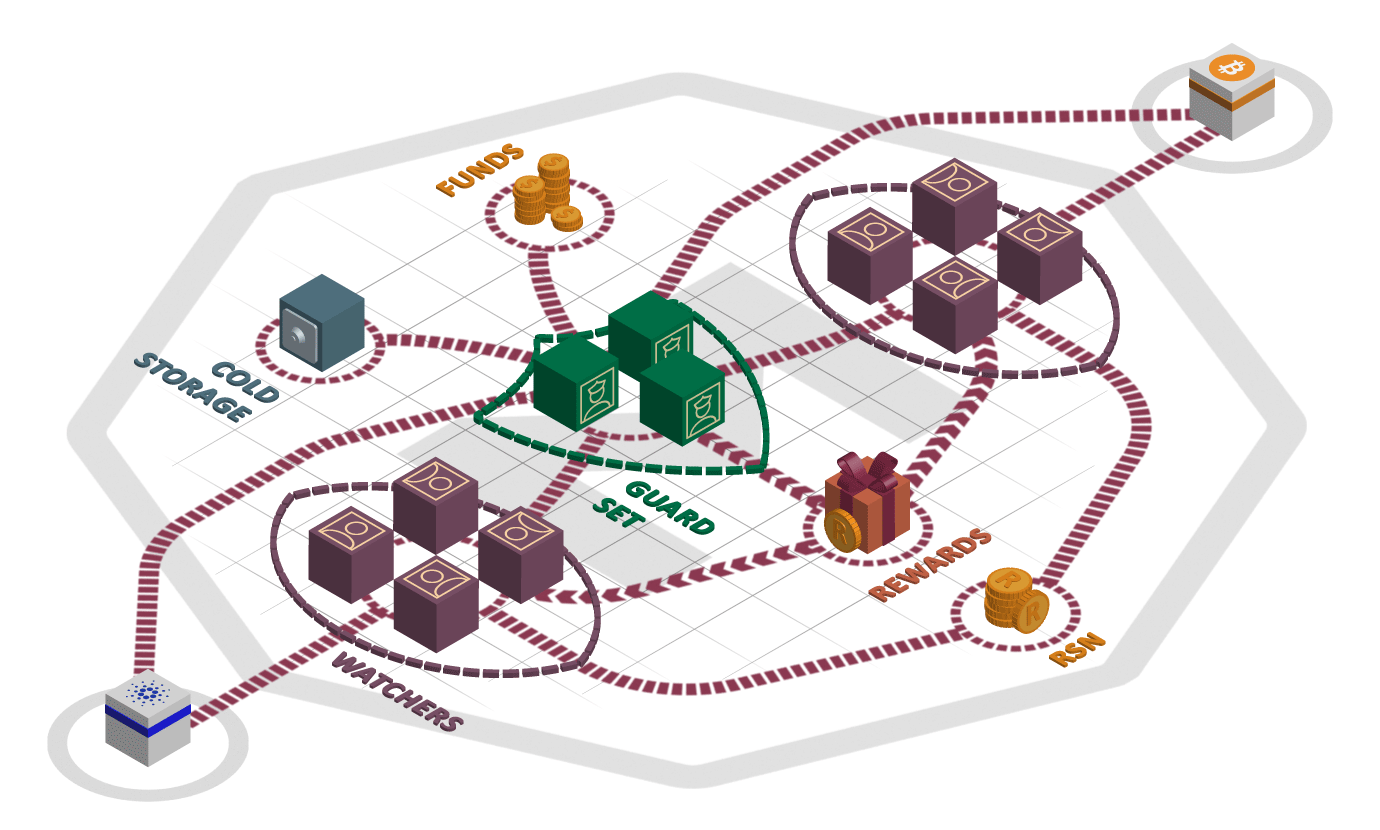

Rosen is an Ergo-centric bridge fortified with multi-layered security protection. In the initial layer, Watchers monitor network activities and report valid bridge-related events to the subsequent layer, Guards. These Guards then carefully process the reported events and execute required actions. In brief, Guards are dedicated to security maintenance and executing responses, while Watchers are focused on the ongoing monitoring of activities and transparent reporting.

Guard Set

Guards are a federated group of entities managing the Rosen core. Their authority over Rosen is restricted through multisignature contracts and wallets. Failure or collusion of Guards will be tolerated while the majority of Guards are healthy. Each Guard has a reasonable amount of funds locked as collateral and will lose all their funds at once in case of malicious behaviour.

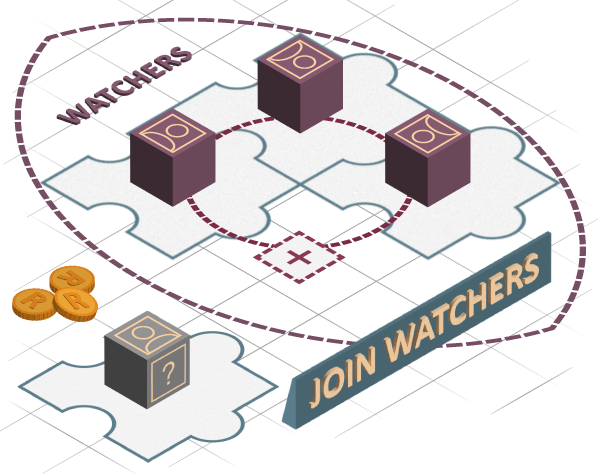

Watcher

Watchers are entities tasked with monitoring a given blockchain (e.g., Cardano, Bitcoin, Ethereum, etc.) and reporting bridge-related events on Ergo. Each blockchain has its own dedicated set of Watchers working together as a cross-chain oracle for Rosen. Watchers will be rewarded for settled transfers but may face penalties for fraud. Anyone can participate as a Watcher once allocating enough RSN and ERG.

Reviewthis articleif you want to contribute as a Watcher.

RSN

RSN is the utility token of Rosen. Watchers are required to put collateral in RSN and ERG by staking, which allows them to acquire reporting permits. Guards need to lock RSN as collateral. Funds will be emitted to the Guard Set and involved Watchers in case of any successful bridge transfers. However, funds will be slashed/collected in case of malicious behavior. When RSN emission has ended, all bridge fees will be collected in the RSN token. Holding RSN will have special fee benefits for projects.

Rewards

Guards are responsible for overseeing the fee structure to create sufficient incentive for all entities. On each successful bridge transfer, the bridge fee will be collected by Guards and a near equivalent amount of RSN will be emitted to the Guard Set and involved Watchers. Guards will add these fees to RSN liquidity pools.

Funds

Rosen Fund is a multisig fund controlled by the Guard Set (other entities might be added at a later time). Rosen’s active and passive revenues like bridge fees, listing fees, portions of token sale revenues, and other futuristic incomes will be collected to this fund. Using this fund, Rosen can engage in providing liquidity and bridge into several chains.

Cold Storage

Bridges are appealing targets for hackers due to the substantial funds they accumulate. Rosen employs multi-signature cold wallets, reducing hackers' incentives. In the event of a bug or hack, only a fraction of the funds will be at risk.

Rosen Verification Layers

Watcher Observation & Report

Individually observing transfer requests and reporting using Ergo.

Each Watcher observes the network individually. They cannot mimic another Watcher's behaviour, which prevents fault cascade.

Watchers Report Aggregation

Creating a finalized report if enough distinct reports are available.

The final report is generated if and only if enough Watchers have reported the same event. A small set of faulty or malicious Watchers cannot generate a final report.

Guard Verification

Verifying the reported event individually.

Each Guard verifies the events before processing. Similar to Watchers, Guards won’t rely on other Guards verifying the same events in order to prevent fault cascade.

Guards Consensus

Consensus on a unique payment transaction.

After a Guard creates a payment transaction, all Guards should reach agreement on the exact transaction to prevent deadlocks.

Guard Multiparty Signature

Multiparty signing the agreed upon transaction.

Each transaction requires the signatures of a quorum of Guards. Thus, one or a few potentially malicious Guards cannot generate arbitrary transactions.

Guards Payment

Submitting and auditing the final signed payment transaction.

All events and payments are audited by all Guards to prevent double-payment.

Who can become a Watcher?

Anyone. You can actively contribute to the expansion and security audit of the Rosen Bridge by becoming a Watcher. Watchers receive rewards for accurate reporting.

How can I become a Watcher?

Configure and run the Watcher app for your desired network.

Top it off with enough RSN and ERG.

Put in collateral and receive reporting permits.

Enjoy reporting and getting rewards.

Tokenomics

Rosen Bridge is designed to bootstrap liquidity across multiple ecosystems.

The Rosen Token serves the as a sybil resistance mechanism for the Rosen framework, a fee distribution mechanism, and means to access services of the Rosen Bridge.

Any user can join as a Watcher given they meet the collateral requirements needed to participate, and earn rewards for their services.

| Token Allocation | Number of Tokens | % of Total Supply | Distribution Method |

|---|---|---|---|

| Initial Liquidity Bootstrapping (Ergo and Cardano) | 100,000,000 | 10% | Liquidity pool and ISPO |

| Future Liquidity Bootstrapping (New Chains) | 385,000,000 | 38.5% | Liquidity on new chains |

| Event-Based Emission (Rewards) | 250,000,000 | 25% | Event-based |

| Passive Staking | 25,000,000 | 2.5% | Staking rewards |

| Team Budget | 105,000,000 | 10.5% | 48-Months vested |

| Treasury | 105,000,000 | 10.5% | 48-Months vested |

| Ergo Foundation | 30,000,000 | 3% | 48-Months vested |

Road map

EVM chain adaptor

Ethereum bridge

Binance Smart Chain bridge

More EVM-chains integration

Expanding the Guard Set

Cold wallets activationIn progress

Seamless cross-chain bridging between supported chains

Additional data sources support for integrated chainsIn progress

Ergo bridge

Cardano bridge

Bitcoin bridge

Dogecoin bridge

Firo bridgeIn progress

Nervos Network bridgeIn progress

Handshake bridgeIn progress

More non-EVM bridges

UI/UX improvementsIn progress

Wallet integrations

Rosen SDKIn progress

Enable fee payment with RSN token

Market making and liquidity provisioning for listed tokensIn progress

Chain Integration Kit for adding new volunteer chainsIn progress

Integration with bridge aggregators and hubs

NFT bridge

Data bridge